The Retirement “Experience Gap”: Why Having Money Isn’t the Same as Enjoying It

Most people spend decades carefully building their retirement nest egg. They save diligently, live within their means, and make smart investment decisions. But when the time finally comes to enjoy the wealth they’ve accumulated, many find themselves facing an unexpected challenge: spending it.

I’ve seen this “experience gap” play out more times than I can count. Clients reach retirement with the financial resources to live well, yet the old habits of saving, deferring, and tightening the belt remain firmly in place. The result? They have the money, but they’re not getting the experiences, fulfillment, or peace of mind they imagined.

From Saver to Spender: A Hard Transition

It’s not easy to flip the switch after 30 or 40 years of saving. Retirees worry:

- “What if I live longer than expected?”

- “What if markets crash?”

- “What if unexpected medical expenses wipe me out?”

These are legitimate concerns. But without balance, they can lead to a life that’s financially secure yet emotionally unfulfilled.

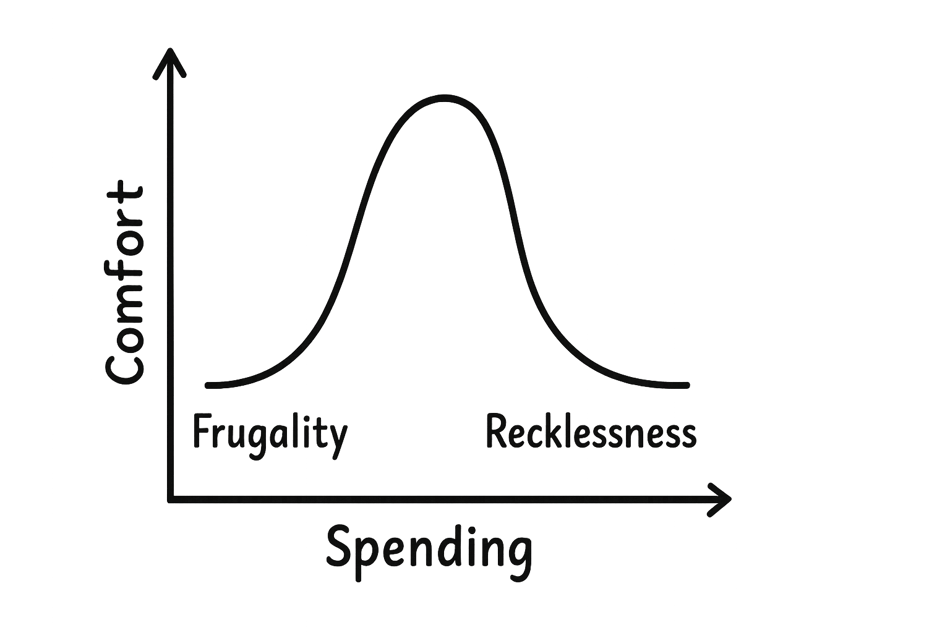

The Spending Comfort Curve

I often describe retirement spending as a comfort curve. On one side, you have frugality—living as though you’ll run out tomorrow. On the other, you have recklessness—burning through money without regard for the future. Somewhere in the middle is the sweet spot: spending confidently on the things that matter most, while knowing your long-term plan still works.

Getting there requires more than just numbers on a spreadsheet. It requires clarity about your values, priorities, and vision for this stage of life.

Money and Meaning

Here’s the irony: if you don’t spend your money in ways that enrich your life, your heirs probably will. I’ve seen children and grandchildren joyfully take vacations, remodel homes, and buy cars with inheritances—things their parents never felt comfortable doing for themselves.

The question is: do you want to be the one who enjoys the fruits of your labor, or leave that entirely to the next generation?

Bridging the Gap

Bridging the retirement experience gap takes intentional planning. That means:

- Building in guardrails so you know what you can safely spend.

- Using strategies that create predictable income streams, so spending feels secure.

- Aligning your financial plan with the experiences and memories you want to create.

When you see the numbers support your lifestyle—and not just your account balance—you gain the freedom to enjoy what you’ve worked for.

Retirement is not a rehearsal. You don’t get a second run at it. If you’ve done the hard work of saving and investing, the next challenge is giving yourself permission to live.

Because at the end of the day, money is just a tool. It’s what you do with it—the experiences you create, the memories you make, and the impact you leave—that defines whether your retirement was truly well-lived.